I was getting my haircut two days ago and I couldn’t help but think about how it correlates to risk. I know what you’re thinking….Who on earth would even think of this? I would that’s who!

Risk correlation, a fundamental aspect of insurance, refers to how different risks are related and influence each other. This concept can be illustrated through a seemingly mundane activity such as getting a haircut and its connection to broader risks in business insurance.

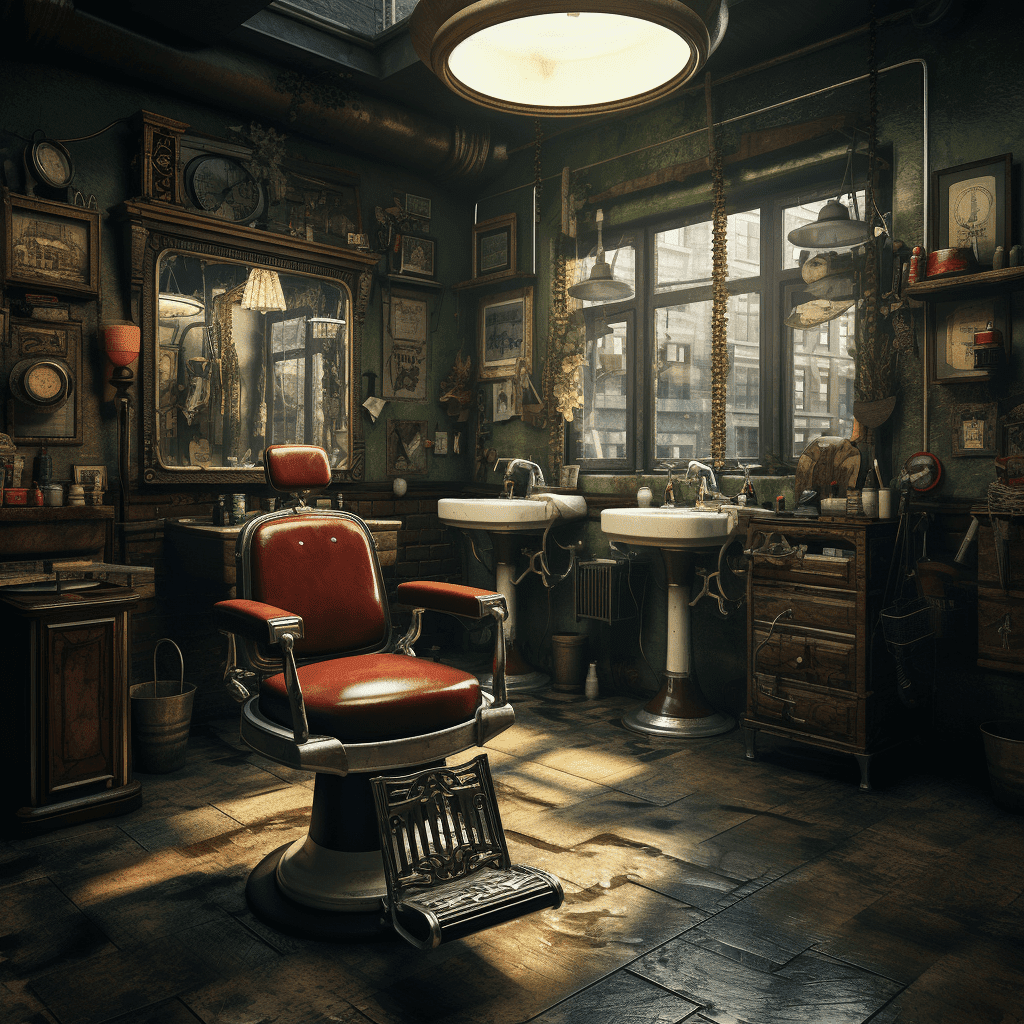

Stay with me here and let’s consider the risks involved in getting a haircut. These include the skill level of the barber or stylist, the cleanliness of the salon, and the use of proper tools. A bad haircut, an injury from a slip, or an infection due to unsterilized equipment are direct risks associated with this activity.

Now, let’s correlate this to business insurance. A salon owner needs to insure against these risks. They would typically have liability insurance to cover injuries to customers and professional liability insurance for claims against their service quality. Here, the risk of an individual getting a haircut is directly related to the salon’s operational risks.

This correlation can also extend to larger scales. For instance, if a new hairstyle trend suddenly demands specific skills or tools the salon doesn’t possess, it could lead to business loss, highlighting the need for business interruption insurance. Similarly, if a health hazard is linked to a hair product used widely across salons, it could lead to mass claims, affecting insurers and underlining the importance of risk diversification.

Understanding risk correlation, as shown above between getting a haircut and business insurance risks, is crucial. It helps in identifying potential areas of vulnerability, ensuring that both individuals and businesses are adequately protected against unforeseen events. This practice can correlate to almost every industry if you can’t identify the risks and how the correlate you can find yourself devastatingly exposed. This is what we do we help close those risk gaps and identify the potential for loss even in what seem to be the most mundane tasks.