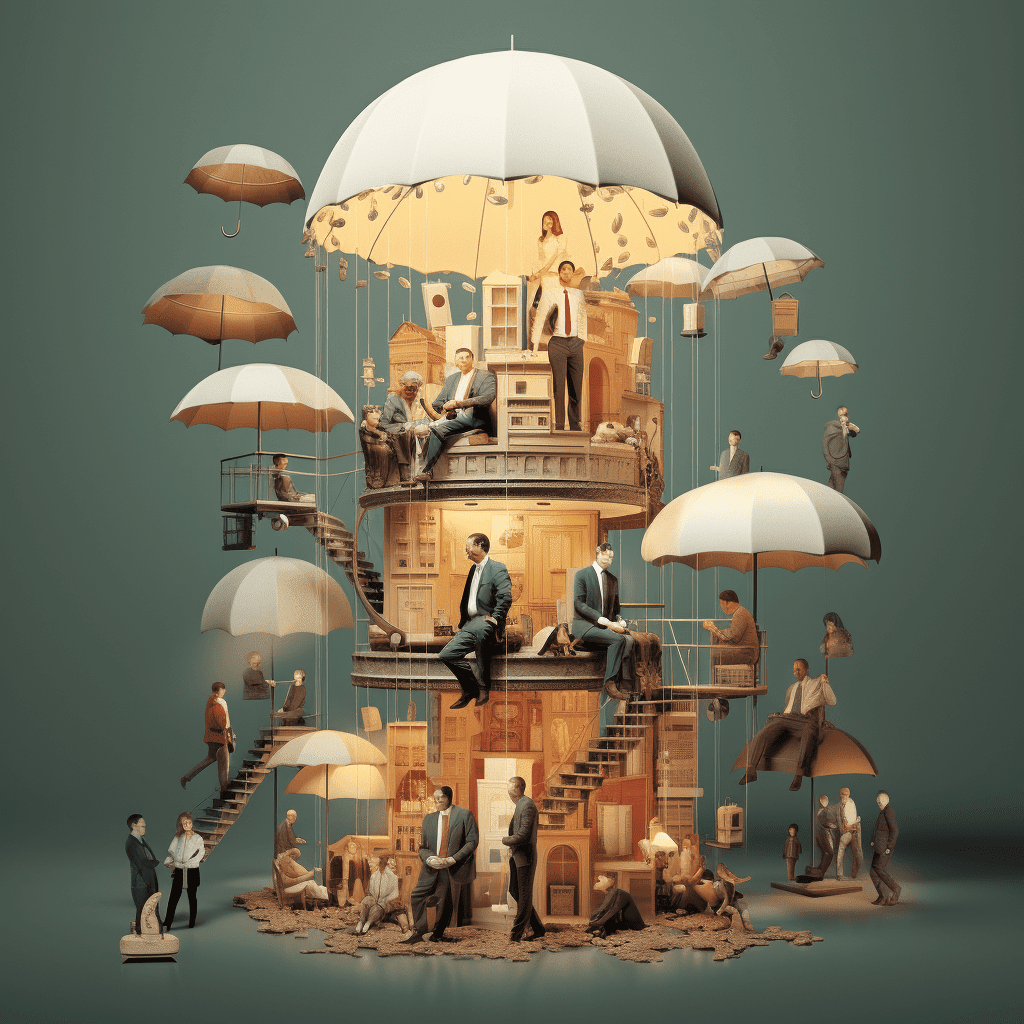

What is Key Man Life Insurance?

Key man life insurance, also known as key person insurance, is a critical policy that companies take out on their most valuable assets – not their products or services, but their key employees. These are individuals whose expertise, leadership, and vision are crucial to the company’s operations and success. This insurance policy is designed to protect the business in the event of the untimely death or incapacitation of such pivotal personnel.

Why Key Man Life Insurance is Essential for Businesses

-

Financial Security: The loss of a key person can significantly disrupt business operations and lead to financial instability. Key man insurance provides a financial cushion, allowing the company to continue operations while dealing with the loss.

-

Business Continuity: The proceeds from the policy can be used to cover the costs of recruiting and training a replacement, ensuring business continuity. It also provides time and resources to restructure if necessary.

-

Debt Protection: For businesses with outstanding loans, key man insurance can be instrumental in ensuring that these debts are covered, particularly if the key person was integral to securing those loans.

-

Investor Confidence: Having key man life insurance demonstrates to investors and stakeholders that the business is proactive in managing risks, which can enhance investor confidence and stability.

-

Tax Benefits: Depending on the region and the specifics of the policy, premiums paid on key man insurance can often be tax-deductible as a business expense.

How Does Key Man Life Insurance Work?

The company purchases a life insurance policy on the key employee, pays the premiums, and is the beneficiary of the policy. If the insured individual passes away or becomes incapacitated, the company receives the insurance payout. This payout is intended to offset the financial loss incurred due to the absence of the key individual.

Who Should Be Covered?

Key persons are not limited to top executives or founders. They could be anyone whose absence would significantly impact the company’s financial health – this includes top salespeople, IT specialists, creative minds, or anyone with unique skills or knowledge crucial to the business.

An Investment in Stability

Key man life insurance is more than just a policy; it’s an investment in the stability and future of your business. It’s a strategic decision that ensures that the company can withstand the loss of crucial individuals and continue to thrive. In today’s ever-changing business landscape, this insurance is not just advisable; it’s essential for any forward-thinking business.